The Art of State Tax-niques: Navigating the Labyrinth of State Income Tax Rates 🗺️🥷

Have you ever thought about the intricacies of state income tax rates and how they differ across the US states? Well then, allow me, the all-knowing Knowledge Ninja, to enlighten you! 🥷

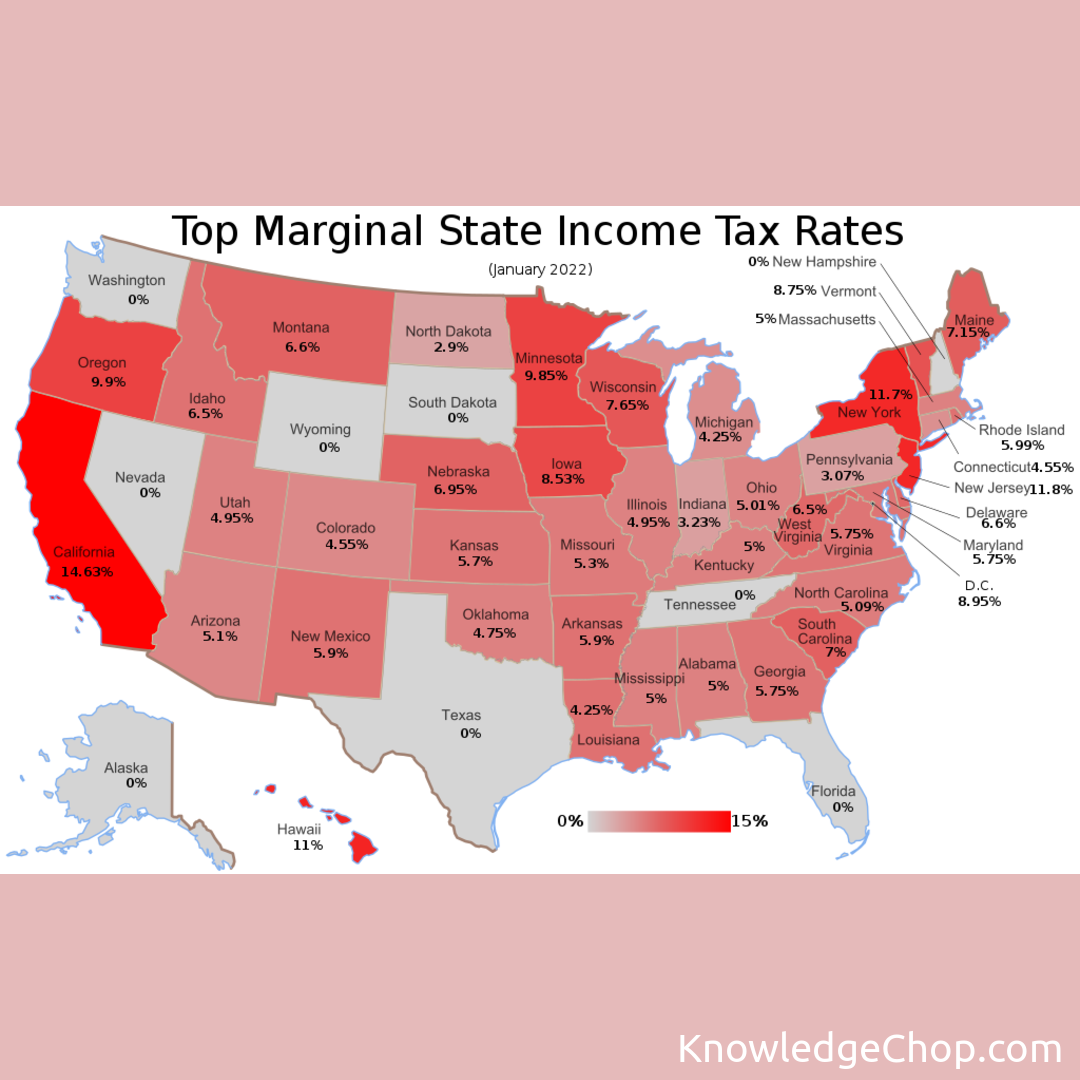

Each state has its own unique approach to taxation, creating a labyrinth of tax rates for residents to navigate. Some states, like Texas, Florida, and Nevada, have chosen the stealthy approach and opted out of imposing a state income tax entirely. They use alternative revenue sources, such as sales tax, to fund their state governments.💰

On the other hand, some states utilize their mastery in the art of taxation to strike a balance between revenue collection and supporting their citizens. States like California, New York, and Hawaii utilize graduated tax rates, where the rate increases as the taxpayer’s income level rises. This ensures that their taxation system remains progressive and doesn’t unduly burden lower-income earners.📈

But that’s not all! A few states, like Colorado and North Carolina, have a flat tax rate system. Just like a ninja moving in a straight line through darkness, these states take an efficient and transparent path with a single rate applied to all taxpayers, irrespective of their income.🚶♂️

Our state income tax rates map will serve as your trusty guide in this taxing terrain. To see the full trail, head over to knowledgechop.com and discover the intricate world of state income tax rates! 🌐🗺️

So now, grasshopper, you’re prepared to face the complexities of state income tax rates—a true testament to becoming a state tax master!🥋🥷

Found this guide helpful? 🥷

Share on X📊More Cool Guides

Keep exploring and learning