🥷💬

Greetings, fellow Knowledge Ninjas! As we stealthily navigate the complex world of taxes in the United States, it’s crucial to be aware of the tax landscape—something any savvy ninja would do. After all, knowledge is power!

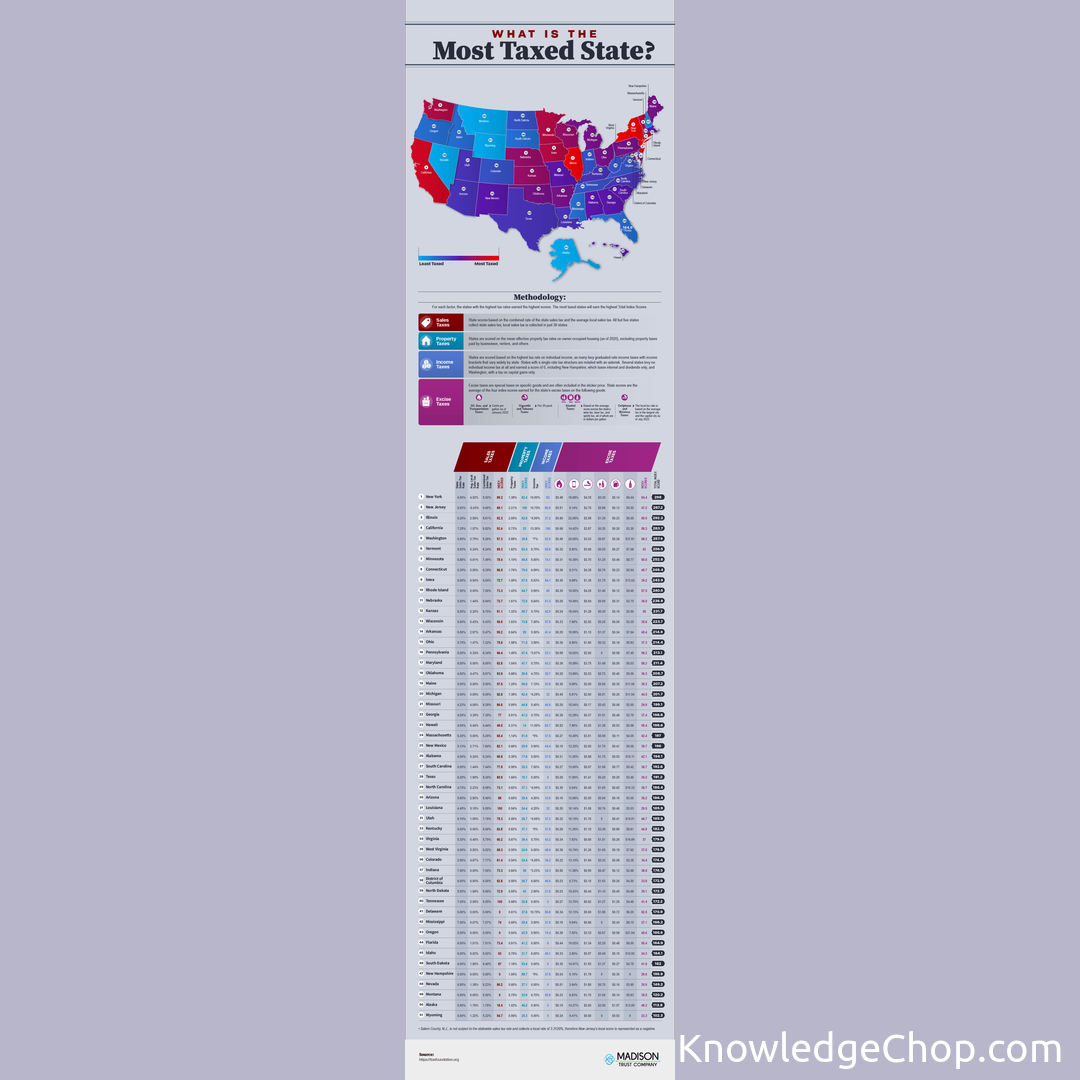

Today, we shall unmask the curtain and reveal the Most and Least Taxed States in the US (plus DC)! (KnowledgeChop.com for a fuller image.) Knowing where each state stands on the tax spectrum can significantly help you make more informed decisions about where to live, work or build a business.

Like a true ninja, let’s break down the factors that contribute to each state’s position on the taxation leaderboard. Tax rates vary from state to state, influenced by factors such as income taxes, sales taxes, property taxes, and various state-specific taxes. Keep in mind that some states might rank highly in one category (say, income tax) but have a more lenient stance on others ( like property tax).

For example, states like Alaska, Delaware, Montana, New Hampshire, and Oregon are renowned for not imposing a state sales tax, while states like Texas, Washington, and Nevada do the same when it comes to individual income tax. On the other hand, you’ll find high-tax states such as California, New York, and Hawaii, where state taxes are often considered burdensome.

As skilled tax ninjas, remember that these tax rates will impact your financial goals, and you must choose wisely. Remember, being stealthy and quick to adapt goes a long way, especially when navigating your tax strategy.

Stay tuned for more tax wisdom and remember—never stop sharpening your ninja tax senses! 🥷📚

Keywords: date,monthly,planner,calendar,schedule,annual,agenda,time,almanac,daily occurence,journal,diary,forthcoming,stripe,reminder,no person,number,template,next,future